Qualify to Save ~30% When You Pay with HSA/FSA

How to Check Out at Nolah with HSA/FSA Funds

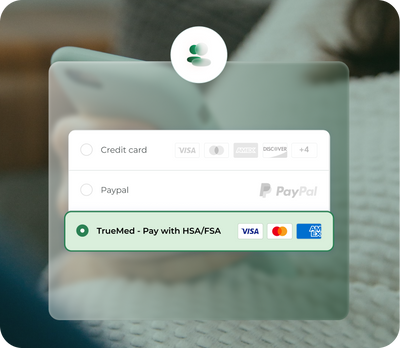

Choose Truemed as Your Payment Method at Checkout

Ensure you are not signed into Shop Pay. If you are, log out and continue as a guest.

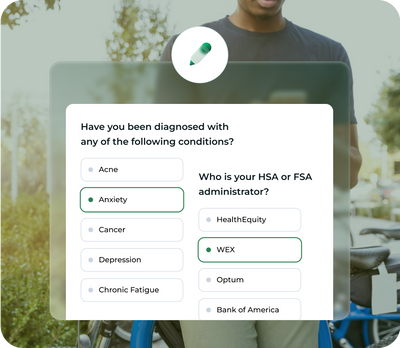

Complete the Health Assessment

Take a quick, private health survey. A licensed provider will review your answers to determine eligibility. If you qualify, Truemed will send you a Letter of Medical Necessity.

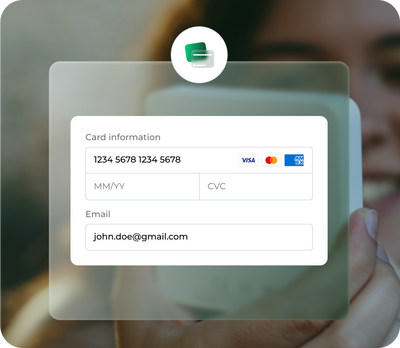

Make Your Purchase

Pay with your HSA/FSA card or a credit card. If you use a regular credit card, Truemed will send reimbursement instructions.

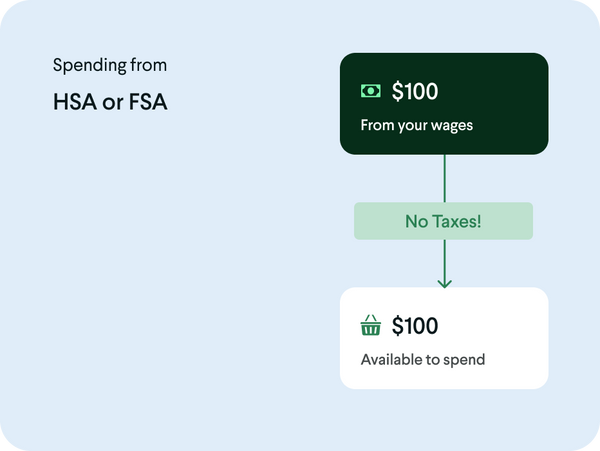

Pre-Tax Purchasing Power

How Using HSA/FSA Funds May Help You Save on Quality Sleep

At Nolah, we believe that getting consistent, quality sleep is essential to leading a happy and healthy life. Through our collaboration with Truemed, eligible customers can use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds on select Nolah products! This means you may be eligible to purchase your mattress, adjustable base, or other sleep accessories with pre-tax dollars, resulting in net savings.

HSA/FSA accounts enable individuals to spend pre-tax dollars on products and services that may treat, mitigate, or prevent a diagnosed medical condition. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

*On average, 30% of gross income is paid to state and federal tax. Individual tax rates vary. To see your estimated savings, check out the TrueSavings Estimator.

What Is Truemed?

Truemed makes it easy to invest in your health and spend pre-tax dollars on qualifying healthcare interventions. Our Truemed partnership provides a seamless platform to request a Letter of Medical Necessity from a licensed provider, and if eligible, use your HSA/FSA funds right on our website. It’s fast, secure, and helps shoppers save on the products and services they need to stay fit and feel their best.